Generally Accepted Accounting Principles (GAAP), and the SEC regulates the Company's disclosure to investor. Trading information is readily available, financials are reconciled to U.S. exchanges provide holders with the same level of information as any other U.S. Investors can receive annual reports and proxy materials in English.

Trading is conducted through market makers in that particular security. Brokers can access information about OTC securities through the National Quotation Bureau's (NQB) "Pink Sheets" or the OTC Bulletin Board. In addition, ADRs also trade Over the Counter (OTC). If an ADR is exchange-listed, investor also benefit from readily available price and trading information.ĪDRs can be found on the New York Stock Exchange (NYSE) as well as on Nasdaq. market regulations and permit prompt dividend payments and corporate action notification. In addition, ADRs trade, clear and settle in accordance with U.S. You can find a complete list of companies with ADRs at our website, Go to "dr universe", then click on "Universal Issuance Guide."ĪDRs allow you to diversify your portfolio with foreign securities easily.

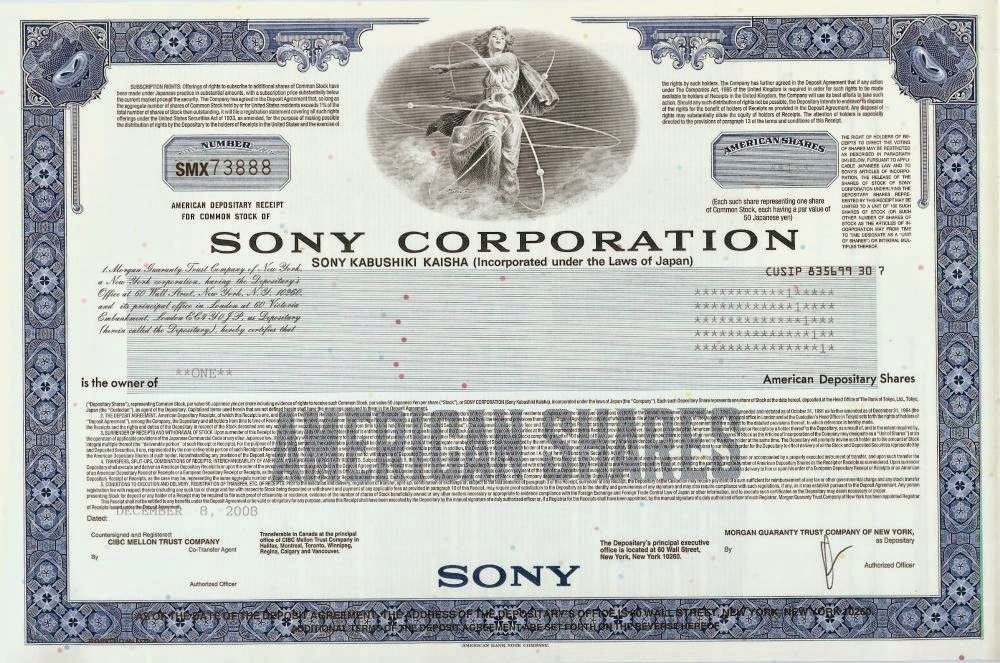

investor through ADRs including companies such as LM Ericsson Telephone Co., Nokia Corporation, Philips N.V., CEMEX and Pioneer Corporation. Many of the best-known international names are available to U.S. company seeking to raise capital in the U.S. dollars, providing annual meeting services and executing corporate actions.ĪDRs issuers are typically large multinational corporations. While many ADR programs are established with a 1:1 ratio (one underlying share equals one depositary share), current ADR programs have ratios ranging from 100,000:1 to 1:100.Ī depositary is a bank that provides stock transfer services in connection with a depositary receipt program, including issuing and canceling ADRs, maintaining the register of holders, distributing dividends in U.S. The relationship between the ADR and the ordinary share is referred to as the ratio. For example, GDRs (Global Depositary Receipts) are DRs that are offered to investors in two or more markets outside the issuer's home country.Įach ADR can represent one, more than one, or a fraction of underlying shares. The concept of a DR (Depositary Receipt) also works in markets outside the U.S. The term "ADR" is often used to mean both the certificates and the securities themselves.

companies.Īn American Depositary Receipt (ADR) is the actual physical certificate whereas an American Depositary Share (ADS) is the actual share. investors, and to provide a corporate finance vehicle for non-U.S. ADRs were specifically designed to facilitate the purchase, holding and sale of non-U.S. Also, ADR dividends are paid to investors in U.S. certificate representing ownership of shares in a non-U.S. How can I find out dividend and corporate action information on a company?Ĭan I have my dividends directly deposited into my bank account?Īn ADR is a negotiable U.S. How can I contact Citi's Shareholder Services? How can I obtain information about my account? What is the difference between a Registered holder and a Beneficial ADR holder? What are the risk factors in buying an ADR? Is it easy to get information and updates on an ADR company? What is the difference between an ADR and an ADS?ĭoes the term "DR" have a broader meaning than "ADR"? What is an American Depositary Receipt (ADR)?

0 kommentar(er)

0 kommentar(er)